The Central Warehousing Commission will release the CWC Recruitment 2024 in the coming days for multiple vacancies. Once the recruitment is out, all the interested candidates can download the CWC Notification 2024 and then check the overall details regarding the vacancy. The Central Warehousing Corporation Recruitment 2024 consists of multiple vacancies for which eligible candidates can fill the Online Form. We have mentioned the instructions by using which you can fill the CWC Application Form 2024 on the official website. After that, Apply Online CWC Recruitment 2024 and start preparing for exam.

CWC Recruitment 2024

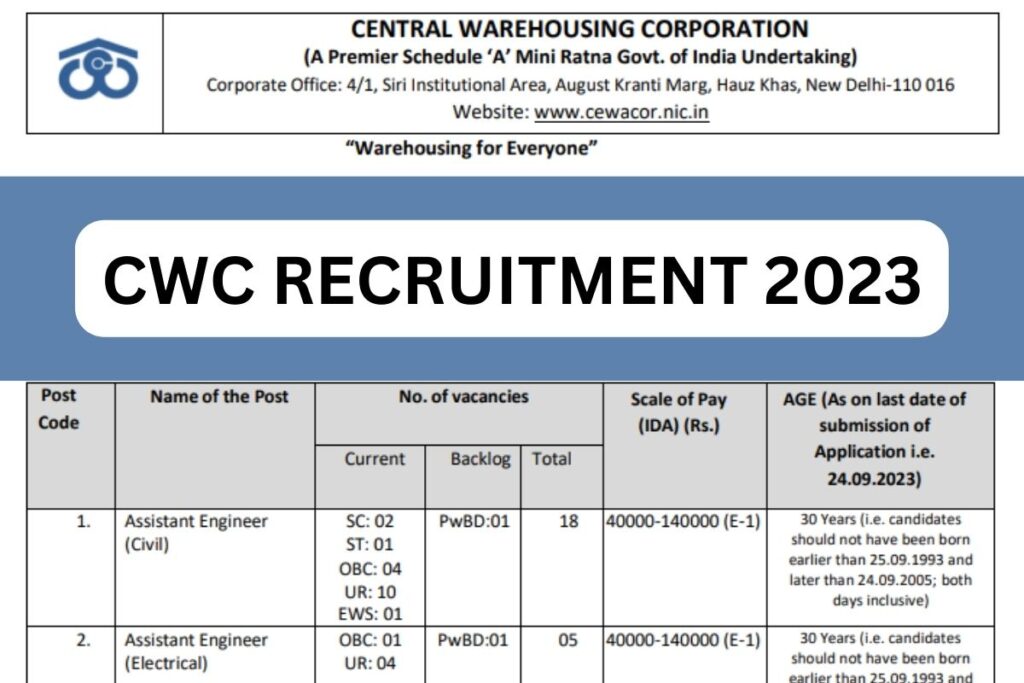

The Central Warehousing Corporation is going to publish an advertisement for CWC Recruitment 2024 for various posts in the Warehousing department soon. These posts are assistant engineer, accountant, junior superintendent, junior technical assistant, accountant, Hindi Translator, etc. There is no official news about the total number of vacancies for these posts but it is expected that the Corporation will release the recruitment for these posts approximately 800. The mode of application will be online so candidates who are interested in these posts can apply online when the form application begins. The application link will activate on the official website of the board candidate can visit the official website to apply for these posts. There are posts available for experienced or non experienced or fresher candidates. This is a National level examination. The examination will be completed using offline mode. The duration of the examination will be 150-180 depending on the posts. This is a central level examination so posting of the selected candidates can be anywhere in India.

- Agniveer Result 2024, Army, Navy, Air Force Merit List PDF

- JSSC CGL Result 2024, Graduate Level Cut Off Marks, Merit List Link

- SSC CHSL Notification 2024, 10+2 Recruitment, Application Form

- MGSU Result 2024, mgsubikaner.ac.in BA BSC BCOM Result

- KPSC Group C Result 2024 Date, Cut Off Marks, Merit List Check

- ICC T20 World Cup 2024 Schedule, Team List, Player List, Venue

- ESIC Clerk Recruitment 2024, UDC Notification Vacancy, Apply Online

- UIIC Assistant Result 2024- Cut off Marks, Merit list

- PM Tractor Yojana 2024 Registration -Application Status @ pmkisan.gov.in

- BPSC 70th Notification 2024 – Recruitment Application Form Link

- Haryana Police Constable Recruitment 2024, Notification @ hssc.gov.in

- IBPS Exam Calendar 2024 – SO, PO, Clerk Exam Schedule Pdf Download

- SSC JE Recruitment 2024 – Junior Engineer Notification Pdf Release Date

- Punjab Police Recruitment 2024, Constable & SI Application Form, Vacancy Link

- SSC GD Admit Card 2024 – GD Constable Hall Ticket Download @ ssc.nic.in

- RRB Staff Nurse Recruitment 2024 – Notification, Application Start Date

- IPL 2024 Schedule – Team, Player List, Venue, Time Table @ iplt20.com

- Gujarat Forest Guard Result 2024, Cut Off, Merit List PDF

- AFC Asia Cup Schedule 2024 – Fixtures, Teams, Group A, B, C, D, E, F

- WBPSC Food SI Admit Card 2024 (Out), FSI Exam Date Download @ wbpsc.gov.in

- Bihar Deled Admit Card 2024, deledbihar.com Call Letter Download

- HPBOSE Time Table 2024, HP Board 10th 12th Date Sheet @ hpbose.org

- PSEB 12th Date Sheet 2024, Punjab Board XII Arts, Sci Commerce Exam Date

- Bank Aadhar Seeding Status Check, uidai.gov.in Seeding Form Online

- MJPRU Result 2024: Rohilkhand University BA, BSc, BCom Results @ mjpruiums.in

- APPSC Group 2 Hall Ticket 2024, psc.ap.gov.in Admit Card Link

- LU Result 2024 – Lucknow University BA, BSc, BCom Results Link

- CUET UG 2024 Registration, Exam Date, Application Form Online

- TS EAPCET 2024 Notification – Application Form Online & Eligibility

- BU Jhansi Result 2024, Bundelkhand University BA, Bsc,Bcom Result Link

- Jio Bharat GPT Release Date – Registration Online, Features

- Vikram University Result 2024: BA, BSc, BCom 1st 2nd 3rd Year Link

- EMRS Result 2024- TGT, PGT & Hostel Warden Cut Off Marks, Merit List Link

- TNDTE Diploma Result 2024 – dte.tn.gov.in Marksheet Check

- NICL AO Admit Card 2024 – Prelims Exam Date Download Link

- PM Kisan Status Check 2024 – pmkisan.gov.in 16th Installment List

- CBSE Date Sheet 2024 (Out): Class 10th 12th Time Table @cbse.gov.in

- UP Vridha Pension List 2024, Old Age Pension Status Check @ sspy-up.gov.in

- Calcutta University Result 2024 – BA, BSc, BCom 2nd, 4th, 6th Semester Result Link

- PM Kisan 16th Installment 2024 Date, Beneficiary List, Payment Status

- SBI Apprentice Result 2024 Date – Cut Off Marks, Score Card Check

- Maharashtra Forest Guard Result 2024, Vanrakshak Cut Off Marks

- LIC Assistant Notification 2024, Application Form, Apply Online

- BSSC Inter Level Admit Card 2024 – bssc.bihar.gov.in Download Link

- Purnea University Result 2024 – BA, BSC, BCom Part 1, 2, 3 Results Date

- MDSU Result 2024, BA, BSC, BCom Part 1, 2, 3 Result Date @ mdsuexam.org

- Indian Army Agniveer Recruitment 2024 – Notification, Application Form Link

- Aadhaar Card Voter ID Link – Last Date, How To Link, Check Status

- WBPSC Clerkship Recruitment 2024, Notification, Apply Online

- BPSC Agriculture Officer Admit Card 2024 : AO Exam Date

CWC Notification 2024: Overview

The Central Warehousing Corporation is going to release the recruitment CWC Notification 2024 PDF for the various posts soon. The number of vacancies in this department is approximately 800. Candidates who want to apply for these posts can check Eligibility Criteria, Educational Qualification, Age Limit, Experience (if needed for that post), Pay scale, Examination Pattern, Examination Process and many more details from the official notification of this recruitment. The official notification will be released soon on the official website. Candidates can visit the official website to download the official notification for these posts.

| Department | Central Warehousing Corporation (CWC) |

| Post | Various posts |

| CWC Notification 2024 | Out Now |

| Total Vacancy | 153 Posts |

| Age Limit | 18 to 35 (Expected) |

| Type of Employment | Govt. job |

| Application Mode | Online |

| Starting date for application | 26 August 2023 |

| Last date for application | 24 September 2023 |

| Application Fees | 700 -1000 Approx. |

| Selection process | Written Examination, Skill / Typing test/ Interview(If required) & Document Verification |

| Negative marking | 0.25 marks or ¼ marks |

| Official Website | https://cwc.gov.in/recruitment |

CWC Vacancy 2024

The Central Warehousing Corporation is going to issue a recruitment notification for approximately 800 posts. There is no official news regarding the release date of notification but it is expected that the notification will be released in the last week of August 2024. These posts can be assistant engineer, accountant, junior superintendent, junior technical assistant, accountant, Hindi Translator, etc.

| Post | CWC Vacancy 2024 |

| Various posts | Approx. 800 |

Qualification Eligibility For CWC Vacancy 2024

The Educational qualification for these CWC Recruitment will be mentioned by the board in the official notification of this recruitment. There will be different educational qualifications for different posts such as for Engineering post candidate must have a Diploma or certificate of engineering , for Accountant job candidate must have CA/CS certificate or graduation in BCOM etc according to the post.

Central Warehousing Corporation Recruitment 2024 Selection Process

The selection process of CWC recruitment will be mention in the official notification of the recruitment but it is expected that the board will follow these given process for compilation of this examination:

- Written Examination

- Skill / Typing test

- Interview(If required)

- Document Verification

Central Warehousing Corporation Recruitment 2024 Age Limit

The Central Warehousing Corporation has not publish the official notification till now so there is no official news regarding age limit but according to the previous examination of the Corporation the age limit will be given below:

Minimum Age: 18 years

Maximum Age: 30 years

CWC Exam Date 2024

The Central Warehousing Corporation is going to execute the CWC Exam Date 2024 in the coming days. There is no official news regarding the examination date but it is expected that the Corporation will execute this examination in November 2024. Candidates who want to get this job should start their preparation for this examination because this is a national level vacancy and a lot of candidates will appear in this examination.

CWC Admit Card 2024

The CWC Admit Card 2024 will be released on the official website of the Corporation. It is expected that the admit card will be released 3-4 days before the date of examination. Candidates who applied for this examination can visit the official website of the board to download their admit card. Candidates can download their admit card through Roll Number / Registration number or Password /date of birth and then appear in the exam for Central Warehousing Corporation Recruitment 2024.

CWC Result 2024

The Central Warehousing Corporation is going to execute the Central Warehousing Corporation Recruitment 2024 examination in November. After the compilation of the examination board will release the result of CWC examination on the official website of the Corporation. Candidates who appeared in this examination can visit the official website to check and download their result . Candidates can check their result through Roll Number / Registration number or Password or date of birth.

CWC Cut Off 2024

The Central Warehousing Corporation will release the cut off according to the difficulty level of the examination. According to the cut off marks Corporation will prepare the result and release it on the official website of the Corporation. The cut off marks will be prepared according to the difficulty level of the question paper, total number of attempted questions, wrong attempt questions, etc. Cut off marks will be different according to the category of the candidate.

How to Apply Online CWC Recruitment 2024

Candidates who want to apply for the Central Warehousing Corporationvarious posts can fill their form after the application date begins to Apply Online CWC Recruitment 2024. Firstly, the board will release an official notification regarding this examination. All the candidates have to read that notification carefully and check their eligibility for that post. If the candidate is eligible for that post , read the required documents details and collect all the documents before applying for that post. Open a web browser and visit the official website of the board that is https://cwc.gov.in/recruitment. Home page of the website will be open now, click on the Employee’s corner Tab and choose recruitment. Then select the CWC Recruitment 2024 and click on the apply now option. Register yourself as a new user if you are applying for the first time and fill your required details to create your ID password. Login yourself by using these ID passwords and fill out your CWC Application Form 2024 with all required details. Pay your application fee and submit your application form. Save your application form on your device.

Direct Links

| CWC Recruitment 2024 | https://cwc.gov.in/recruitment |

| CWC Notification 2024 | https://cwc.gov.in/recruitment |

FAQs of Central Warehousing Corporation Recruitment 2024

There is no official news about the official notification but it is expected that the official notification will be issued in August,2024.

you can get or download official notification for Central Warehousing Corporation Recruitment 2024 from the official website of the Corporation.

The starting date of CWC Application Form 2024 submission is expected in September 2024, and the closing date is in October 2024.

The application fee to Apply Online CWC Recruitment 2024 is expected between Rs. 700 to 1000.

Yes, there is 0.25 or ¼ marks negative marking for every wrong answer.